Dearborn Public Schools Board of Education on June 19, 2023 approved a preliminary $490 million budget for the 2023-24 fiscal year and earlier in June discussed again the need to ask voters to reapprove the district’s 10-year Hold Harmless millage within the next year.

Hold Harmless taxes were created in 1994 when the state approved Proposal A to overhaul school funding. Districts like Dearborn Public Schools, where voters had already approved better school funding than the state was going to provide, were allowed to keep that additional revenue through Hold Harmless millages.

District voters have to re-approve those Hold Harmless millages every 10 years. The last renewal was in November 2014.

Hold Harmless millages have two parts, one for homeowners (those with a primary residence exemption) and one for other property owners called non-homestead. Together, the tax generates about $43 million for the district, with $37 million coming from the non-homestead taxes. The revenue is part of the district’s general fund, meaning it can be used for any expenses including salaries, benefits, utility bills, technology and infrastructure, said Tom Wall, Executive Director of Business Services and Operations.

The Board of Education has not decided when or if it will ask voters to extend the Hold Harmless millage.

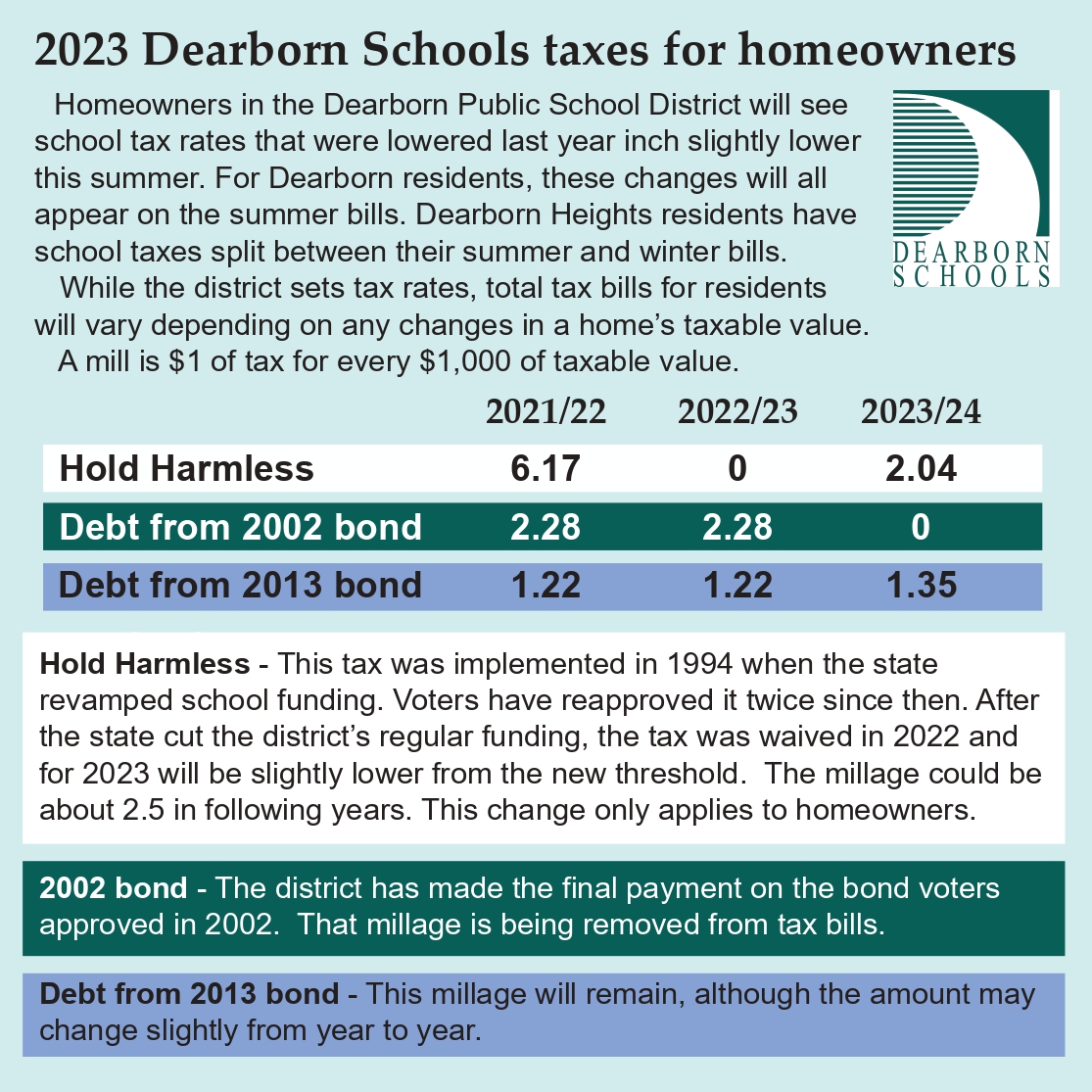

For non-homestead properties, the Hold Harmless tax rate has been 18 mills across the state since Proposal A was enacted. A mill is $1 of tax for every $1,000 of taxable value.

For homeowners, the Hold Harmless rate was 6.17 mills until last year. As part of a significant funding change two years ago, the state reduced how much the district is allowed to collect in Hold Harmless from homeowners. Previously, the district was expected to collect $594 per student or up to 6.17 mills from the Hold Harmless tax. Now, the district is capped at $313 per student. That means the exact millage rate will vary each year based mostly on a combination of district enrollment and total taxable value in the district. Dearborn Public Schools expects the rate to be 2.04 mills for the coming year and around 2.5 mills the following year. The district is collecting a lower rate this summer to make up for the last $1 million in previous overpayments.

That means homeowners who saw a notable decrease in the school portion of their tax rates last summer will see another tiny rate reduction this summer. (See a graphic of tax rate changes here.) While district tax rates have declined over the last two years, total tax bills for residents will vary depending on any changes in a home’s taxable value.

Legislators lowered the district’s Hold Harmless cap for homeowners in the fall of 2021, long after that summer’s property tax bills had been mailed with the higher rate for the year. To compensate for the overcollection, the district did not levy the Hold Harmless taxes on last year’s tax bills for homeowners and is reducing this summer’s tax rate for that group. The return of the Hold Harmless tax millage in July will be offset by a 2.15 mill reduction as the district pays off infrastructure bonds approved in 2002. Another 1.35 millage remains on the tax bills to pay for the school infrastructure bond approved in 2013.

The end of the bond millage will also impact non-homestead properties. Those business and rental property owners did not see any reduction from the changes in Hold Harmless because the non-homestead rate stays at 18 mills. If voters ever fail to reapprove the 18 mills non-homestead Hold Harmless tax, the state would not make up the funding loss to the district. Those expected revenues would continue to be deducted from the per pupil funding the district receives from the state.

The portion of Hold Harmless charged to homeowners could be removed from tax bills if the state raises the district’s per pupil funding level enough to cover the difference. For the current year, that difference is only $222 per student, down from about a difference of about $2,900 when Proposal A passed nearly 30 years ago. If the state later cut per pupil funding below the district’s threshold, the Hold Harmless millage could return for homeowners if voter approval was still in place.

Preliminary budget

At the June 19, 2023 meeting, the Board of Education also approved next year’s preliminary budget.

Mr. Wall explained that the district does not yet know how much funding it will receive from the state, which accounts for most of the district’s general operating funds. The various budget plans in Lansing all include a notable increase in per pupil funding for schools.

Also not settled is the district’s new contract with the Dearborn Federation of Teachers, which covers about half of the district’s 2,900 employees.

“So if you look at the whole budget, about 70 percent of our revenue is unknown, and about 85 percent of our expenses are unknown. But we are required by law to adopt a budget by July 1st. A lot of this is based on estimates,” Mr. Wall told the Board of Education during their June 5 budget hearing.

The approved district budget includes an estimated increase of $450 per pupil from the state. For the current year, the district received $9,372 in per pupil funding. The budget also estimates that enrollment will decline slightly to about 19,900 students.

Other items to note is that the state is increasing the district’s required contribution toward the school pension fund. Those payments, based on total payroll, will climb about 1.6 percentage points to almost 45 percent of payroll next year. The state covers part of those retirement costs for the district, but the amount from the state varies from year to year.

Next year will also be the first time since 2020 that the district will not be receiving any new federal Elementary and Secondary School Emergency Relief (ESSER) funds related to the pandemic. Some building projects already budgeted under ESSER can continue through the summer of 2024. The district was careful with how it spent that money knowing there would be a “funding cliff” when the revenue suddenly disappeared, Mr. Wall said. Still, the end of the funding means that about $8 million a year Dearborn Schools had been dedicating to infrastructure will now have to be again devoted to the salaries and other expenses that ESSER had been helping to fund.

The budgets show the district ending this fiscal year with a $37 million fund balance and next year at $36 million.